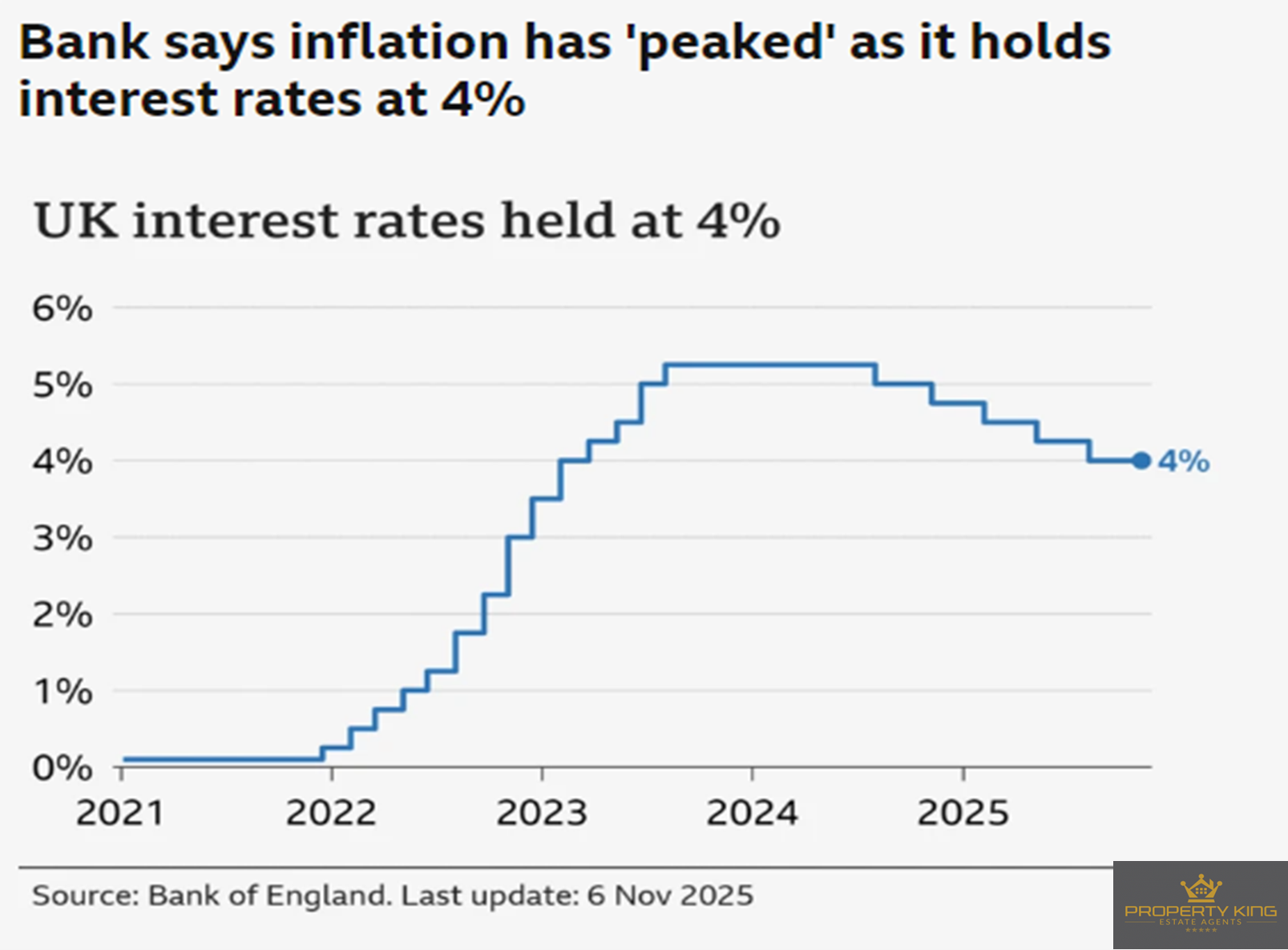

Bank of England holds base rate at 4% for second month

Thu 06 Nov 2025

The Bank of England’s Monetary Policy Committee has today voted to once again keep the base rate on hold at 4%, a move that had been widely anticipated as inflation remains stubbornly high and global uncertainty continues to limit its room for manoeuvre.

When the base rate was cut from 4.25% to 4% in September, it was the third reduction this year. Just a few months earlier, the money markets had been predicting up to four further cuts, but the outlook has changed considerably since then.

STUBBORN INFLATION

Inflation, which the Bank had hoped would have been closer to its 2% target, is stuck at 3.8%, with rising wage costs, higher service prices, renewed energy and shipping costs keeping it elevated.

Even so, the Bank must also take into account the effects of an elevated base rate on a weak economy, with growth flatlining and business investment slowing ahead of the Autumn Budget on 26 November, and Governor Andrew Bailey will now come under increasing pressure from Reeves to reduce the base rate.

Bailey says: “In our decision to hold interest rates today, we have balanced the risk that above-target inflation becomes more persistent against the risk that demand in the economy is weakening, which might cause inflation to fall too low.”

In better news for the property industry, markets still expect one or two further cuts later in the year, depending on how inflation data and Budget policy unfold.

Let's recap some of the key lines from today, after the Bank of England held interest rates at 4%:

- The move did not come as a surprise. Although the inflation rate held at 3.8% in September, coming in below forecasts, most Bank watchers were not expecting a change in interest rates today- The Bank said it judged inflation to have peaked - policymakers voted 5-4 in favour of leaving rates unchanged but said borrowing costs were "likely to continue on a gradual downward path"

- Bank governor Andrew Bailey said rather than cutting interest rates now, he would "prefer to wait and see" if price rises continued to ease this year

- The Bank's decision comes ahead of the government's Budget on the 26th November, where speculation has grown that Chancellor Rachel Reeves will raise taxes

- Reeves said the latest forecast "shows that inflation is due to fall faster than previously predicted", but shadow chancellor Mel Stride said interest rates were "staying higher for longer because Rachel Reeves does not have a plan or a backbone